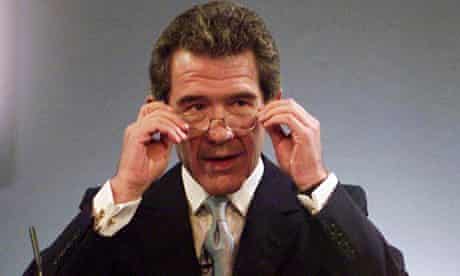

Yesterday morning, the British Museum announced that George Osborne will be its new Chair. He is a completely unsuitable choice. His priorities on both culture and climate are clear: as Chancellor he devastatingly cut the culture sector by 30% while providing huge tax breaks to oil firms.

One of his first challenges will be deciding whether to renew the museum’s controversial sponsorship deal with BP – a company he has multiple links with, and which happens to be one of his current business clients.

The museum’s trustees should rethink their decision to appoint a man where there are such clear conflicts of interest. Here are just seven reasons why he can have NO say in deciding the future of the museum’s BP sponsorship deal.

1) As Chancellor, he gave HUGE tax breaks to BP and other oil firms to encourage them to maximize the volumes of fossil fuels that they would extract from the North Sea.

2) He was the champion of the government’s so-called “dash for gas”, a boost to the fossil fuel industry’s attempts to dangerously frame fossil gas as a “bridging fuel”.

3) As part of this, he provided BIG tax breaks and incentives to fracking companies such as Cuadrilla, which was headed by…former BP CEO John Browne!

4) Until recently, he was a US fund manager for BlackRock, one of BP’s and the fossil fuel industry’s biggest investors. Vice Chair of BlackRock Philipp Hildebrand – who also sits on the Board of the British Museum – recruited George Osborne to be a US fund manager for the firm. BlackRock is one of the top 10 owners of BP.

5) Crucially, Osborne remains a partner at investment bank Robey Warshaw, where BP is currently one of its major clients. In particular, Robey Warshaw advised BP on the $10.5bn acquisition of shale assets from BHP Group in 2018.

6) Osborne is also Chair of the Partners Council for Exor, a firm which recently bought a stake in Schlumberger, an oilfield services firm that is contracted by BP all over the world (including for BP’s ill-fated Deepwater Horizon rig).

7) Osborne’s former father-in-law Lord Howell was an Energy Minister at the Foreign Office. But he was also President of the British Institute of Energy & Economics (sponsored by BP) as well as a lobbyist for the fossil gas industry. Many speculated about whether Osborne’s own pro-fossil fuel stance was influenced and strengthened by Howell’s interests.

Given this long list of murky connections and ties, there would be a clear conflict of interest in the new Chair having any say on the future of the BP sponsorship deal. As the Museums Association’s ‘Code of Ethics’ notes: